The U.S. economy is teetering on the edge of a recession. Prices are up. Job creation appears to be slowing. People are seeing the value of their wages decline. It’s a perilous time, yet instead of seeking ways to stimulate economic growth, policymakers in Washington are poised to enact new rules that will take us where we don’t want to go.

We’ve already seen it in the energy sector. President Biden’s initiatives to make renewables the main source of the nation’s power have ravaged the energy sector. Instead of incentivizing domestic producers to ramp up and produce more oil and natural gas to bring prices down, he’s gone hat in hand to the Saudis to ask them to pump more oil. He’s also ordered the release of a million barrels a day from America’s critical petroleum reserves – intended for use only in national emergencies like war and natural disasters – to lower the price.

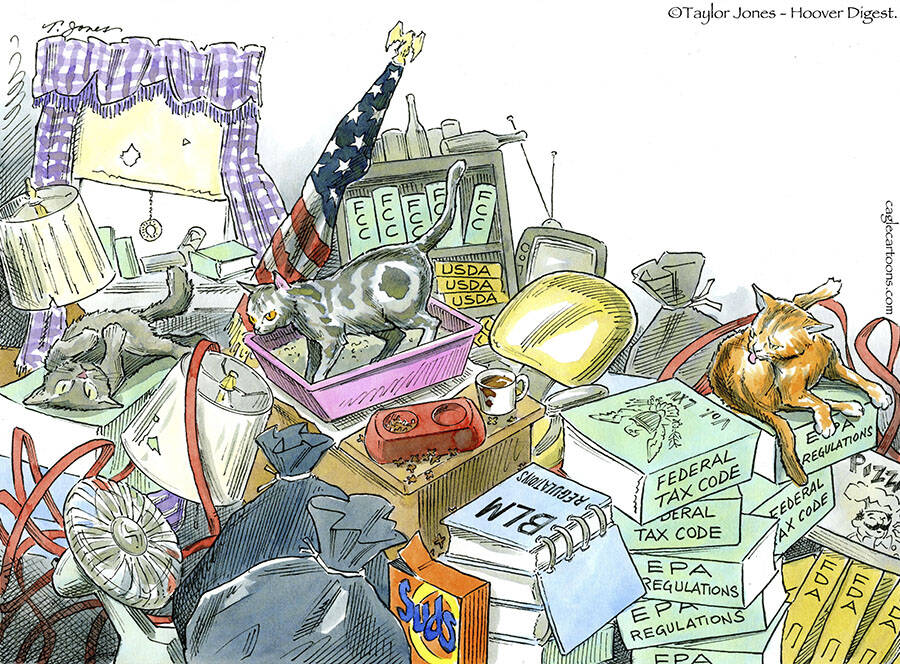

These are bad policy decisions, enforced by the handcuffing of U.S. producers through regulatory means. This is not an anomaly. It’s happening across the economy as the veritable alphabet soup of federal rule-making agencies attempt to force corporate bigwigs to adopt politically progressive ideas, even when it means acting counter to the long-term interests of shareholders and consumers.

Consider the Federal Trade Commission, one of the government’s most powerful regulatory bodies. It’s purportedly an independent agency, a designation that is supposed to leave it free of partisan concerns. Under the leadership of its Biden-appointed chairman, Lina Khan, it’s now trying to use powers it may not have to take on some of America’s biggest companies.

Khan has a radical, anti-free market outlook informed by, according to a recent report produced by the Committee to Unleash Prosperity, a lack of practical, real-world business experience. She’s an academic, a former government attorney, and an ideologue who thinks businesses that are big are inherently bad and need Washington’s input regarding what they can and cannot do. Problematically, her agenda to bring central planning back from the Harvard University storage locker in which it’s been kept since the late 1980s runs headlong into a recent ruling by the Supreme Court.

In West Virginia vs. U.S. Environmental Protection Agency, the court reined in the ability of federal agencies to make policies and expand their purview without specific congressional authorization. Hopefully, that will keep Khan coloring within the lines, at least for a while.

Even without that decision, the FTC’s wings have been clipped over the last few years. In April 2021, the high court ruled unanimously the commission could no longer impose large fines on companies as part of its effort to remediate bad behavior. Going forward, two more cases the justices will hear will force them to address the fundamental unfairness of the administrative trial procedures these regulatory agencies commonly employ.

The constitutional guarantee of due process granted to defendants in criminal cases isn’t exactly the standard used by the administrative law judges who oversee hearings on behalf of regulatory agencies. Their approach is more akin to the “Heads we win, tails you lose” challenge fathers have used to teach impressionable children a valuable lesson about how life can be unfair.

It can be said, with the agency acting as prosecutor, judge, and jury in such instances, the process is unfair to those these agencies have the authority to regulate. With the deck stacked like that, it’s no wonder the success rate for cases brought by the FTC over the last 25 years approaches 100%, even when the administrative law judge overseeing the case initially found in a defendant’s favor.

Unless the FTC changes course on its own – and it’s doubtful it will as long as Khan is chairman – the efforts to strip away its statutory authority will continue. This is as it should be. Reform is needed, now, that preserves the standard that actual harm to the consumer must be at issue. Needless new regulations punishing companies with a bottom line a bureaucrat thinks is too big will not get the economy back on its feet. Instead, it will bury it.

Peter Roff is a media fellow at the Trans-Atlantic Leadership Network, a former columnist for U.S. News and World Report, and senior political writer for United Press International.