“In this world, nothing can be said to be certain but death and taxes.”

That quote is often attributed to Ben Franklin or Mark Twain, but whoever said it, no truer words have ever been spoken.

I filed my annual income tax extension on April 18, the last day of this year I was able to do so.

Every year, I vow to get my tax receipts in order and to my CPA by early March, and every year I don’t and must file an extension.

To make the task easier for me, my CPA set up a Quicken account that allows me to record in real time every check that comes in and every expense that goes out.

But I don’t use that convenient tool as I should, either — and I never know for certain how much money I’ll receive back from the IRS or have to pay until October, when my 2021 return is finally due.

Taxes are on my mind all year long, regrettably, and it seems in one form or another they are always due.

I can always sense when it’s tax-paying time: It’s when I start to save a little money and enjoy, wrongly, the exhilarating sense that I am finally getting financially ahead.

In the autumn I have to pay taxes on my house and the handful of rental properties I’ve been able to scrape together — and the taxes are sizable.

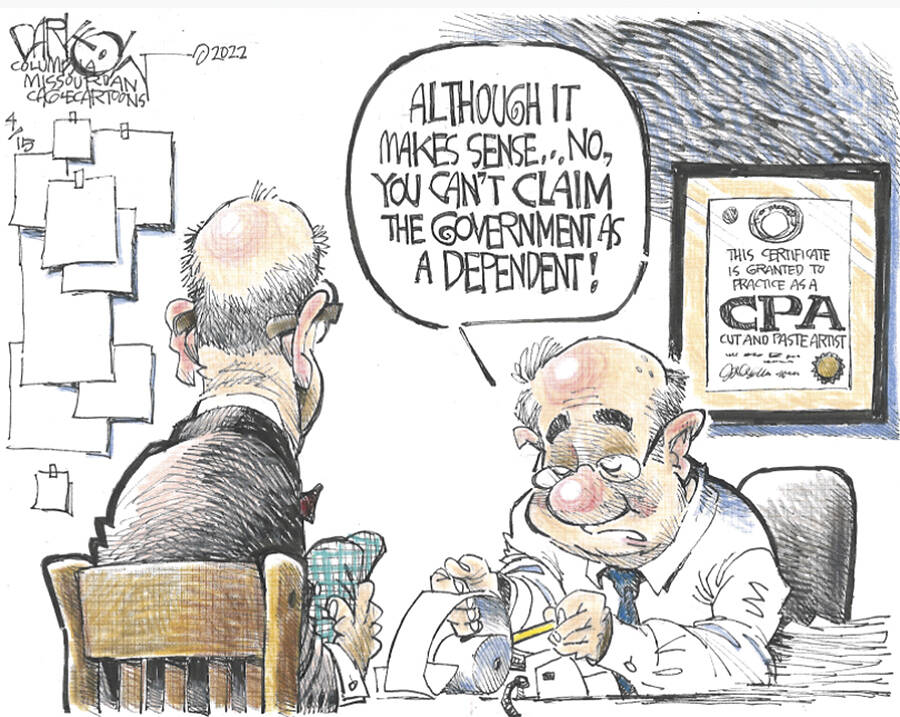

Then when spring rolls around I have to write a massive check to the IRS and be reminded that my silent business partner, the federal government, always gets its cut of my income.

Most people agree that some taxes are necessary and some government is necessary — but I’d be a lot happier if our federal government were half as big and my taxes were half as much.

The truth is, despite a record windfall in federal tax revenue — it’s up 26% over the first five months of fiscal 2022 — Washington is spending $2 trillion more than it’s taking in.

The more revenue that’s sucked into D.C., the more the politicians in charge there want to spend it — and the more they want to raise taxes to do so.

The “Biden Administration is proposing $2.5 trillion in tax increases over 10 years,” reports the Wall Street Journal.

Our national debt already stands at an incomprehensible $30 trillion, yet we keep spending with abandon and ignore the advice of genuine leaders who worried about our spendthrift ways long ago.

“As we peer into society’s future, we — you and I, and our government — must avoid the impulse to live only for today, plundering for our own ease and convenience the precious resources of tomorrow. We cannot mortgage the material assets of our grandchildren without risking the loss also of their political and spiritual heritage. We want democracy to survive for all generations to come, not to become the insolvent phantom of tomorrow.” – Dwight D. Eisenhower

Well, Ike, we sure could use more leaders like you today — both Democrat and Republican — who see reckless government spending for what it is: robbing future generations to subsidize the current generation.

All I know is that though I can extend filing my tax return until October, I still had to pay my estimated taxes by April 18, — which meant, as usual, I had to dramatically downsize my savings account.

That’s why taxes are always on my mind.

Tom Purcell is an author and humor columnist for the Pittsburgh Tribune-Review. Email him at Tom@TomPurcell.com.